Vented natural gas is the controlled release of produced gas into the atmosphere. It typically comes out of solution with the produced oil but in many cases it is simply leakage from pipe, valves, tanks or instrumentation. Some facilities have infrequent, small releases while some sites release gas up to and beyond regulated limits. Natural gas release is a particularly bad carbon emitter because it is mostly made of methane, which has 25 – 30 times the global warming potential than carbon dioxide per unit mass.

The video above represents a release rate of what I would estimate to be about 2,000 cubic meters per day. Such releases are common in the Canadian oilfield even when there are regulations in place to keep producers under the allowed limits of 500 cubic meters per day vent rate.

Why do oil producers vent their natural gas?

Producers do not want to release natural gas into the atmosphere, they want to sell it to a market like they are selling their oil. At the very least they are supposed to dispose of it properly through flaring or incineration. With gas prices expected to remain low for the foreseeable future due to an oversupply from new completions technologies, traditional conservation solutions such as installing pipelines simply have no payout. Even high volumes of waste gas will not pay out at a measly value of $1-2 CAD/GJ when the pipeline and compressor required to get the gas to market will typically cost in the high six figures.

Not only are market prices low, but in these cases where the gas supply is a byproduct of oil production there is also the risk that the oil well will become uneconomic before the gas pipeline ever pays out. In Canadian heavy oil fields we one such occurrence “watering out” – the oil production breaks to 100% water and is no longer profitable to produce. In these catastrophic lost production cases any investment into a gas pipeline would simply have been sunk and irrecoverable.

Flaring, incineration and combustion.

Flaring is the next choice when conservation is uneconomic, but even flaring has it’s hurdles. The benefit of flaring is that is it a more environmentally responsible means of disposing the excess gas because it converts methane into carbon dioxide and water, which together has less warming potential than methane.

A typical flare stack on an Alberta oil site will rarely cost less than $30,000 CAD to install after all is said and done. Beyond the direct costs for equipment and installation there are other onerous requirements such as lease expansion and landowner approvals that must in place. The red tape associated with a flaring or incinerator approval ends up costing valuable production downtime and man-hours to overcome. That’s why producers will always prefer to vent the gas whenever they can because it is simply more cost effective!

Typical flare stack.

While I won’t go into detail about the creative ways producers sometimes attempt to hide their non-compliant venting from regulators, let’s just say that the reported volumes of vent gas are definitely far lower than what is happening in the field.

Bitcoin fixes this.

The Drake Well, drilled and completed in 1859, is argued to be the first commercially successful oil drill that sparked the first oil boom in the United States. Today, after one hundred and sixty years of associated natural gas disposal and waste, we finally have a technology that has the potential to conserve (monetize) this stranded energy that makes up the vented and flared byproducts from oil wells – the Bitcoin network!

The late (and great) Hal Finney recognized immediately how the Bitcoin network was a green energy technology:

Hal was not only a visionary but also a great innovator. Hal recognized very early that Bitcoin miners gave electricity a baseline value no matter where it was located on the planet. Since bitcoin miners are paid through the internet and awarded bitcoin the value of electricity is now directly correlated with the value of bitcoin. This means that stranded, useless energy located even on a remote oil well has the same baseline value as useful grid-connected energy flowing from a hydroelectric dam! Bitcoin is remarkable.

The Bitcoin network is effectively an extremely efficient arbitrage mechanism. Miners can deploy their hashpower practically anywhere in the world and produce the exact same value for the energy consumed. In doing so it literally gives anyone access to liquidity with minimal barriers to entry. It is simply revolutionizing.

Note – I realize many of you reading this are new to bitcoin and bitcoin mining, but since this post is not about teaching you about either I’ll just refer you to this incredible set of resources that will set you on the right path.

Conserving waste with Ohmm® mining datacenters.

I started my professional career in 2011 as a mechanical engineer focused on upstream oil and gas facilities and I’ve always had a strong passion for finding ways to improve oil production processes for producers. Being based in Canada’s heavy oilfields I learned that vented natural gas had long been a major problem and one that we engineers and operators have always wanted to solve.

When I learned about Bitcoin mining in 2016 it clicked immediately that this technology was the solution – all we needed to do was build a portable bitcoin mining datacenter fueled from natural gas.

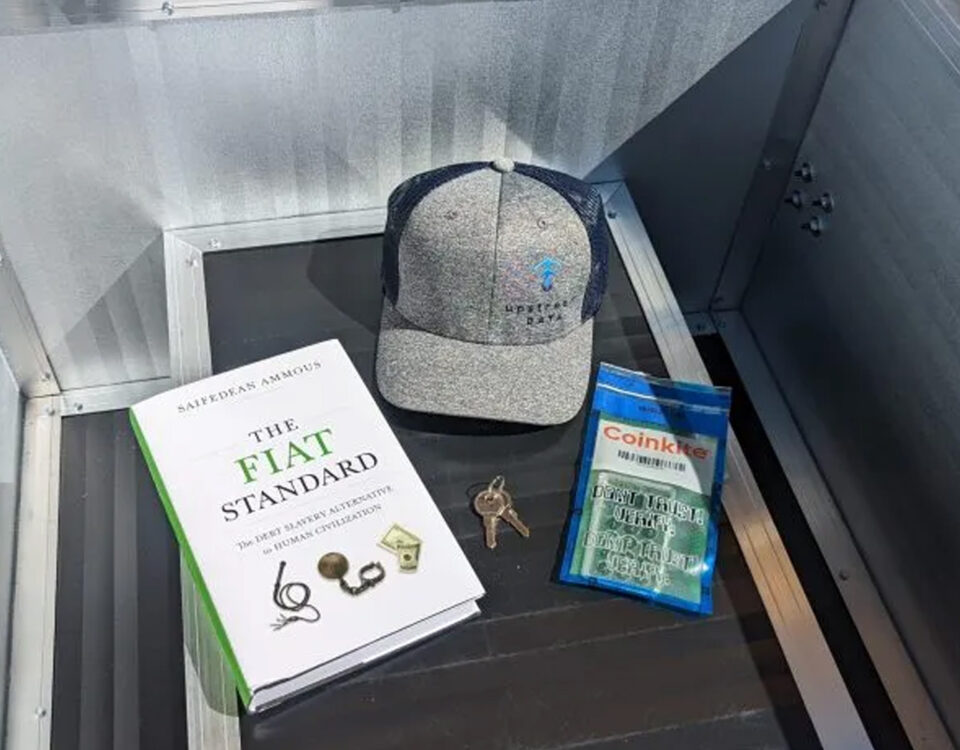

Ohmm® Combo mining datacenter fueled by vent gas on a remote oil well in Alberta, Canada.

I did some research and found that seemingly nobody had yet caught on that bitcoin mining could solve this stranded gas problem, so I set out to solve it. I started Upstream Data Inc. in January 2017 and our first product, the Combo datacenter shown above, consists of a natural gas genset and bitcoin mining datacenter all housed in a modified 20′ shipping container. These units can be moved around within a couple hours’ notice and tied directly into vent or flared gas sources regardless of where they are located. A cellular modem and directional antenna ensures a 24/7 internet connection and 24/7 revenue generation.

More recently we have been developing new products that fit a wider application range including a small 50 kW Ohmm ‘Mini’ and a 1000 kW Ohmm ‘Mega’. Our Ohmm datacenters even come with optional remote control and automation capability (remotely start / stop gensets, engine diagnostic history and graphing, shut-down set points and load-following capability when the fuel supply is intermittent). Our datacenters are scalable to consume practically any vent or flare gas volume and they are designed to be modular in nature.

Oil producers who purchase our datacenters are able to monetize their gas directly at the source while also meeting conservation regulations and minimizing emissions penalties. For applications I described above where oil production can suffer catastrophic loss (e.g. watering out), producers can just pick up and move their asset to a new location – there are no sunk costs!

See our products page for more information on our Ohmm mining datacenters.

How profitable is bitcoin mining anyway?

Bitcoin mining is hand’s down the most competitive business on the planet. It is designed to be very easy to get into – literally just download some software and you are mining. This ease of entry is exactly what makes it so difficult to do profitably. Therefore miners are always looking to find the cheapest energy sources to stay profitable. What source is cheaper than wasted natural gas that producers are paying to dispose of?

Bitcoin mining using natural gas is on average 10 – 15 times more profitable than selling the natural gas to the market.

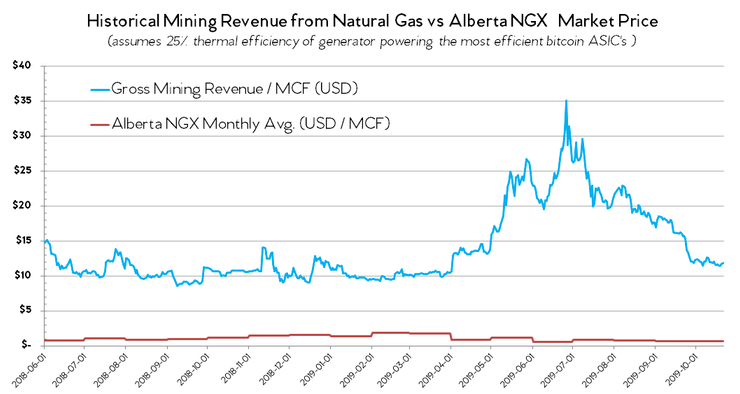

This chart shows the equivalent revenue (Canadian dollars) per GJ of natural gas produced if the producer was to plumb it into a genset that operates at 25% thermal efficiency and generates electricity to mine bitcoin using the most updated ASICs (ASICs are the mining computers, for you newbies). Even older ASICs yield far higher revenue than selling down the pipeline.

The Alberta NGX market price (shown in red) is the primary market price that most upstream producers receive for their gas in Alberta and Saskatchewan, but that is assuming they do not pay any midstream processing or pipeline fees. Producers that purchase our datacenters to mine bitcoin generally earn at least 10 – 15 times more revenue than selling to the market, and that does not even consider the price appreciation. There is simply no money to be made in selling gas anymore, hence the excessive venting and flaring.

Bottom line.

Bitcoin is a significant threat to the business models of many institutions such as financial services, media and central banks, to name a few. Needless to say, there are strong motivations for these institutions to frame Bitcoin in a bad light by pointing out the energy consumption of bitcoin miners as a world ending, ocean boiling threat to human existence.

Fortunately, the energy-waste narrative could not be further from the truth and Upstream Data is one of many start-ups in this ecosystem proving them wrong. Bitcoin fixed the pervasive problem of monetary dilution and in doing so fixes consumerism. It is possibly the greatest gift we could ever give to our environment. Yes, Bitcoin fixes this.

<3 Steve